By Anya Kaats.

Since 2020, some online retailers, including Amazon.com and Airbnb, have erroneously collected 3.5% excess sales tax on deliveries and rentals in the Baca Grande/Grants subdivision and Casita Park. The excess sales tax charged to customers is sent to the Colorado Department of Revenue, where it is then dispersed to the Town of Crestone. The erroneously charged sales tax comprises a significant portion of the Town’s overall budget and has provoked complaints of “taxation without representation,” given that Baca, Grants and Casita Park residents have no voting power nor official representation within the Town of Crestone.

According to the Department of Revenue’s Colorado Sales Tax Lookup, the correct sales tax for services and products delivered to or first used within the Baca, Grants or Casita Park is 5.4%, which includes a Colorado state sales tax of 2.9%, and a Saguache County sales tax of 2.5%. Within the Town of Crestone, an additional 3.5% is collected on purchases and deliveries. Casita Park should also be taxed at a rate of 5.4%, but residents have reported varied results when shopping online. Some use a Moffat address and zip code when shopping online, and seem to be charged an additional 2% city of Moffat tax, while those who use a Crestone address and zip code are being charged the additional Crestone municipal tax of 3.5%.

How did we get here?

Earlier this year, Baca resident Christopher Ryan noticed he was being charged 3.5% in excess sales tax on orders he placed through Amazon. “I had just purchased a house in the Baca and was ordering some big-ticket items for our renovation. After ordering a hot water heater from Amazon for $1,500, I noticed the sales tax seemed high, so I did some research.” After confirming his tax district and doing the math, it became clear to Ryan that he was being charged 8.9% sales tax as opposed to 5.4%. In the case of the hot water heater, this amounted to $50 in excess sales tax. Ryan researched other purchases he’d made online, including orders from Home Depot and Lowes, but it seemed only Amazon was making the mistake.

After multiple emails and hours on hold, Amazon customer service confirmed the error was their mistake, and emailed Ryan with an explanation. “Our third-party tax software provider calculates tax based on the zip code + four-digit extension. Since USPS is unable to assign a four-digit extension to your address, tax cannot be accurately calculated. I’ve confirmed that the correct sales tax rate for your address is 5.4%.” Amazon instructed Ryan to send them documentation for all past orders where sales tax had been inaccurately charged—but offered no long-term solution.

“After spending hours creating excel spreadsheets and sitting on hold with Amazon customer service, Amazon only refunded me for a few of the orders. Ultimately, I decided this strategy wasn’t worth the effort,” Ryan explained.

Eventually, Ryan got in contact with local resident and reporter Sara Grimes, who has written several pieces about this issue in her newsletter, “The Grimes Report.” One of these pieces included an open letter to Brandon A. Davis, local government liaison at the Colorado Department of Revenue. In her letter, Grimes explained that Amazon has been overcharging Baca and Casita Park residents based solely on the shared zip code with the Town of Crestone, even though zip code boundaries are based on mail routes and delivery points, not tax jurisdictions. While there may at times be some correlation between tax districts and zip code boundaries, zip codes are “not a determinative factor in calculating sales tax,” wrote Grimes.

Why is this happening?

In 2019, Colorado passed a “marketplace facilitator law,” requiring online retailers with sales over $100,000 within the state of Colorado to collect sales tax from their customers and remit this revenue to the state.

According to Gwynn Busby, Town of Crestone Treasurer in 2020, sales tax revenue sent to the Town increased substantially after Colorado passed the law. While Busby explained that individual sources of sales tax revenue are confidential to all Town employees aside from the Town Clerk, she felt fairly certain the Town started receiving sales tax not only from residents within Crestone city limits, but also from residents who lived outside the town, in the unincorporated areas of the Baca and Casita Park.

When the revenue first increased, Busby approached then-Town Clerk Allyson Ransom for answers, but Ransom was unable to give her any information claiming confidentiality. Busby took it upon herself to contact the state. “I recall one month the Town received quadruple our average monthly deposit of $17,000 -$25,000, so I called the Department of Revenue to make sure they hadn’t deposited the wrong check in our account. They assured me they hadn’t.” Attempts to reach Allyson Ransom for comment were unsuccessful.

Upon examining the minutes from the Board of Trustees meetings, in August 2020, monthly sales tax revenue reported by Busby did increase substantially. Monthly sales tax revenue increased to $75,405 from an average of $23,000 per month over the prior 17 months. While August 2020 saw the most substantial increase in monthly sales tax revenue, in the months that followed, revenue was still coming in at an average of $45,000 per month, almost double what it had been since early 2019. Average monthly sales tax revenue has remained this high ever since.

In July 2021, Gwynn Busby resigned as treasurer, citing discomfort with how revenue was being spent. “I resigned because the board decided to hire an out-of-town lady for $50 per hour to ‘direct’ Town staff. After seven and a half years, I only made $23 per hour, and I felt that hiring someone for such an exorbitant amount was an insult to existing staff and local taxpayers. There were many steps that led me to quit, but this was the final straw.” The “out-of-town lady” Busby referred to is Leslie Klusmire, who became a contracted interim administrator for the Town from August 2021 through December 2022. Busby was replaced by Treasurer Lisa Cyriacks.

Cyriacks reiterated Busby’s claims that while individual sources of sales tax revenue are confidential, she was able to get information about sales tax generated via online sales compared to brick-and-mortar businesses. In August 2022, at the request of a Crestone trustee, Cyriacks presented this information at the August 8, 2022 board meeting. “Local brick and mortar businesses collect 40% sales tax, and the remainder are all remote sales where I am not able to see where those deliveries were made: to the Town or the Baca. If you compare the number of households in Crestone (107) and the number of households in the Baca Grande (1,100) then the assumption could be that 90% of the sales tax from remote locations is from deliveries in the Baca Grande.”

Several Town employees noted that while they had suspicions that some of the online sales tax revenue was being generated in the Baca, no one was able to officially confirm this. The Crestone Eagle submitted a Colorado Open Records Act (CORA) request to the Colorado Department of Revenue to review sales tax percentages by tax jurisdictions within the 81131 zip code, but was denied based on a statute that classifies “collections on behalf of and reports to local governments” as confidential tax information, adding that “retailers do not report sales taxes collected by zip code to the State.”

The initial increase in sales tax revenue also coincided with the first few months of COVID-19, when consumer behavior was shifting drastically. According to the International Trade Administration, e-commerce revenue nationwide grew by double its projected forecast, increasing 19% in 2020 and 22% in 2021 compared to the forecasted 9% and 12%. Given that Colorado’s Marketplace Facilitator Law didn’t go into effect until 2020, the Town of Crestone had no pre-COVID-19 online sales tax data to use as a comparison. Further compounding the issue, several Town employees and local businesses owners also reported increased brick and mortar sales as a result of the pandemic, given that residents felt safer shopping locally. In other words, even without sales tax revenue from the Baca or Casita Park, it made sense to Town employees that the Town’s revenue was increasing as a result of COVID-19. “I requested when planning the 2022 budget that we not rely on the increase in case it was due to COVID, but I walked out in July 2021 before the budget was finalized,” Busby explained.

“We all figured the Department of Revenue knew what they were doing. Never did anyone purposefully not report this info to the department,” Busby added. Cyriacks also insisted that the Town should not be held accountable for the erroneously charged sales tax. “The Town has very little control over this. The only way this could be remedied is if the Department of Revenue takes this issue up with the retailers who are at fault. It’s a systemic problem.” Trustee Adam Kinney reiterated this sentiment in an email to The Crestone Eagle, stating, “The board was generally told by our past interim administrator (Klusmire) that refusing the revenue was not a choice we could make, and that it was a state department policy.”

Several online retailers use software that calculates local sales tax accurately, such as Land’s End, where customers are asked whether or not they live “in city” or “out of city” at checkout. Lowes, Home Depot, and Walmart also calculate the correct tax rate for deliveries to the Baca.

Airbnb and Amazon, despite having a total market value of $82.7 billion and $1.5 trillion respectively, seem to be using subpar tax software to calculate sales tax. Avalara, a third-party tax calculation software company, explains on their website that zip codes are the “wrong tool” for calculating sales tax. “Like using a tricycle to commute to work, using zip codes to determine tax rates is a mistake. Originally intended to help mail delivery by identifying geographic areas and zones, zip codes lack the accuracy sales tax compliance requires.”

This issue is not unique to Crestone and appears to be nation-wide. Last month, a woman who lives in an unincorporated area called St. Johns County in Florida, received a $750 credit from Amazon for improperly charged sales tax. According to an article on News4Jax.com, “The mix-up happened because she lives in unincorporated St. Johns County; but her shipping city was listed as Jacksonville, so she was charged Duval County’s tax rate, which is higher.”

Affecting the Town budget?

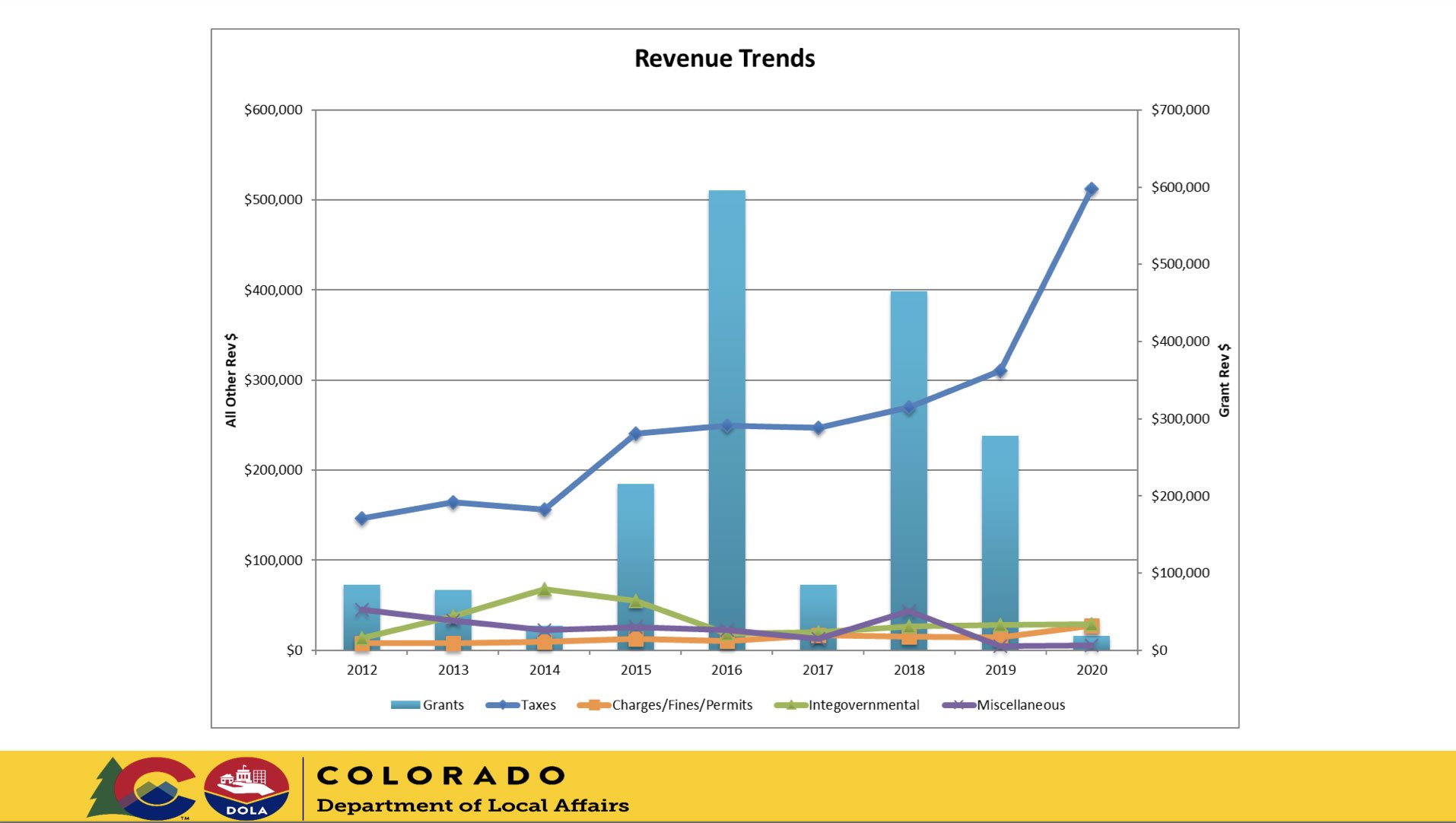

In 2019, the Town’s general fund budget projected $250,000 in sales tax revenue, and ultimately received $273,000. In 2020, after the Marketplace Facilitator Law was passed, the Town budgeted for $257,000 in sales tax revenue, but ultimately received $412,802. In 2021, the Town budgeted for $275,000 in sales tax revenue, but received $435,341. (On April 2, 2020, Crestone voters approved an increase in sales tax from 3% to 3.5%, but the extra 0.5% sales tax revenue has been allocated to the Water & Sewer Fund and Capital Projects Fund, and is not included in this calculation.)

In her 2022 budget recommendation to the board, Klusmire specifically states that the increased sales tax revenue over the previous two years was a result of the pandemic. “During the last two pandemic years—and contrary to initial projects—the Town experienced robust sales tax revenue growth, partially due to the addition of taxes from online purchasing.” By this logic, if the effect of the pandemic on sales tax was responsible for the increased revenue, then it could be assumed that the 2022 budget would reflect an expectation that things would be returning to normal. Instead, Klusmire recommended a substantial increase from years prior, budgeting $514,286 in sales tax revenue for 2022, somehow assuming this discrepancy was the new normal.

Even as Klusmire warned the board against relying on sales tax revenue to fund the budget, citing its volatility, she simultaneously recommended a budget in which sales tax revenue comprised 87% of the general fund. Klusmire resigned suddenly in December 2022, leaving the Town to contend with the fallout of her 2022 and 2023 budget recommendations. Attempts to reach Klusmire for comment were unsuccessful.

Department of Revenue acknowledges the error.

In an email exchange between Brandon A. Davis at the Department of Revenue and local resident Christopher Ryan, Davis confirmed that, “If a property or service is delivered to the purchaser at a location other than the seller’s business location, the sales tax is sourced to the location the purchaser receives the purchased property or first uses the purchased service.” Davis also acknowledged that while he had been previously alerted to the Crestone sales tax discrepancy, he was under the assumption that Baca and Casita Park residents had all of their mail sent to Crestone-based post office boxes, and that no packages were delivered directly to homes. Davis requested evidence and documentation to support claims that Baca residents were being overcharged.

In early November, Ryan sent Davis multiple screenshots showing that Amazon overcharged on orders purchased and delivered within the Baca, and Davis assured him that he now had what he needed to escalate the matter. “We’re working on approaching the vendor now and will keep you posted. Please pass along to residents that it’s being worked on.” Davis added that he will respond with updates as soon as he gets them.

According to the Town’s Colorado Department of Revenue Distribution Summary for Retail Sales Tax, the Town is estimated to receive between $575,000 – $600,000 in total sales tax revenue in 2023. Using Cyriacks’ August 2022 calculation, if the Town receives $575,000 total revenue for the year, brick and mortar sales would account for $230,000. Of the remaining $345,000, $64,500 would be generated by online purchases within the city limits, and $310,500 would be generated by online purchases in the Baca and Casita Park.

If the Department of Revenue proves successful in their attempt to fix the error made by Amazon and Airbnb, the Town stands to lose an estimated $310,500 in annual revenue. Given that the general fund relies on sales tax for about 90 percent of its overall revenue, this loss will be significant.

The error cuts deep

The excess sales tax charged to Baca and Casita Park residents has highlighted areas of ongoing structural dysfunction between the Town of Crestone and its neighboring unincorporated areas, currently under the jurisdiction of the Baca Grande Property Owners Association (POA).

While the Town of Crestone and other municipalities rely on local sales and property tax revenue to pay for infrastructure, maintenance, and other town services, the POA relies on dues from Baca and Casita Park residents to pay for these services. Maintenance and improvements within the POA’s jurisdiction are not subsidized by the Town of Crestone, and residents within the POA are not allowed to vote in Town elections, nor run for elected Town offices. Many Baca residents feel that unless they are represented and given a voice in Town politics, they should not be subsidizing the Town’s budget.

In the case of Airbnb, visitors rather than residents pay the excess sales tax. However, since none of the sales tax revenue generated within the POA’s jurisdiction gets redistributed for use within the Baca or Casita Park, many residents who are already unhappy with the burden imposed by Airbnbs might be displeased to learn that none of the sales tax revenue generated as a result of these short-term rentals comes back to the Baca.

The principle of taxation without representation triggered the American Revolution, when Great Britain collected taxes from the colonies, which had no voice within the British Parliament. Ironically, while the concept of taxation without representation played a significant role in the formation of the United States, even influencing the structure of the U.S. Constitution, there aren’t any laws that explicitly prohibit it. Even today, residents of Washington D.C. pay federal taxes without any voting representation in the U.S. Congress, and while multiple pieces of legislation have been proposed to address this injustice, none have been successful.

In Crestone, Amazon and Airbnb’s sales tax error has illuminated smoldering discontent on both sides of the relationship between the Town of Crestone and residents living within the POA. While many Baca and Casita Park residents feel unfairly excluded from Town politics, many town residents and trustees feel that a town of fewer than 200 people should not be responsible for maintaining and financing a municipal district that supports a community of 2,000.

Trustee Kinney explained that, “The most effective and immediate course of action I can take now is, with the support of the 2024 budget committee, recommend to the board of trustees that we adopt a 2024 budget that will balance without the inclusion of the online sales tax revenue from residents who do not live within the Town boundaries.” While other board members were forthcoming and happy to discuss these issues off the record, when The Crestone Eagle requested comment from the board of trustees and the mayor, we were told that they are not able to issue a statement without an official meeting and approval from their attorney. Trustee Kinney has requested that an official agenda item be added to the December meeting, “to discuss how we can support Baca residents’ efforts to remove municipal sales tax from online purchases.”

The December board of trustees meeting is scheduled for Dec. 14 at 9 a.m., is open to the public and broadcast on Zoom.